He also cited the "vulnerable political setup," "lack of unified national laws," and "divisions among the elite, which have become clear in these crisis conditions."

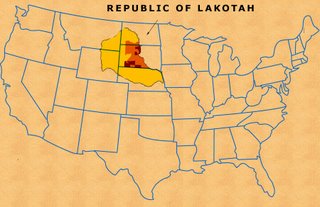

He predicted that the U.S. will break up into six parts--the Pacific coast, with its growing Chinese population; the South, with its Hispanics; Texas, where independence movements are on the rise; the Atlantic coast, with its distinct and separate mentality; five of the poorer central states with their large Native American populations; and the northern states, where the influence from Canada is strong.

He even suggested that "we could claim Alaska--it was only granted on lease, after all."

Is the United States doomed? Probably not--at least not this time. But the Great Depression and this recession show we're more vulnerable to economic attacks than terrorist attacks. If anything will destroy the US eventually, it's our cultural mindset--touting the superiority of excessive, unregulated capitalism. In other words, a philosophy of greed and selfishness--the opposite of what most indigenous people believe.

5 comments:

The actions of the government agencies Fannie-Mae and Freddie-Mac in regards to mortgages, starting in 1999, are at the root of the economic meltdown, and are anything but unregulated capitalism. But it was indeed a policy of greed and selfishness, as are many policies by government as well as the private sector.

"Hippo-cratic"

A major component of this serious "meltdown" on all of these economic fronts is the totally unbridled, all-American mentality of rampant over-consumption - the bigger house, the bigger car, the bigger burger - buy, buy, buy! More, more, more!

The poor chap who perished last week at that Walmart in New York on Black Friday - the last thing he probably saw were several 500-pound women (black, white, or whatever in terms of ethnicity) charging at him like a horde of enraged hippos.

He died for their sins.

True...

the poor guy who was crushed by the herd of black hippos was a black guy. his famliy is gonna get paid.

Here's some info on who's responsible for the present financial crisis:

http://www.philly.com/philly/blogs/attytood/Paulson_takes_time_out_from_saving_the_world_to_bow_down_to_the_Reagan_myth.html

"All in all, I think we hit the jackpot," Reagan said on Oct. 15, 1982, when he signed into law a bill that lifted many restrictions on the savings-and-loan industry, giving thrifts the power to make larger real-estate loans and compete with money market funds. Some jackpot. It turned out that the deregulation of the S&L's unleashed a corrupt rush into risky and often corrupt real-estate dealings, often involving insiders, and the nation's thrift industry teetered on the edge of collapse just months after the Gipper left the Oval Office in January 1989. Within months, Reagan's hand-picked GOP successor, George H.W. Bush, was forced to push through a bailout package with a value of $160 billion--which would be a lot of money now but was a huge amount of money 19 years ago. This is what Craig Shirley calls "Reagan's legacy of small government and deregulation."

The reality is that Reagan's "legacy of small government" took America from a creditor nation to the world's biggest debtor nation during his eight red-ink-ridden years in the White House. You can very easy straight line from the era of Reagan in the 1980s, from "greed is good" insider trading on Wall Street and his steep tax cuts for millionaires and billionaires--to our 2008 of sub-prime mortgages, credit default swaps and CEOs with their runaway pay and their golden parachutes and their bailout-seeking jaunts on corporate jets.

http://www.nytimes.com/2008/12/21/business/21admin.html

There are plenty of culprits, like lenders who peddled easy credit, consumers who took on mortgages they could not afford and Wall Street chieftains who loaded up on mortgage-backed securities without regard to the risk.

But the story of how we got here is partly one of Mr. Bush’s own making, according to a review of his tenure that included interviews with dozens of current and former administration officials.

From his earliest days in office, Mr. Bush paired his belief that Americans do best when they own their own home with his conviction that markets do best when let alone.

He pushed hard to expand homeownership, especially among minorities, an initiative that dovetailed with his ambition to expand the Republican tent—and with the business interests of some of his biggest donors. But his housing policies and hands-off approach to regulation encouraged lax lending standards.

Mr. Bush did foresee the danger posed by Fannie Mae and Freddie Mac, the government-sponsored mortgage finance giants. The president spent years pushing a recalcitrant Congress to toughen regulation of the companies, but was unwilling to compromise when his former Treasury secretary wanted to cut a deal. And the regulator Mr. Bush chose to oversee them—an old prep school buddy—pronounced the companies sound even as they headed toward insolvency.

As early as 2006, top advisers to Mr. Bush dismissed warnings from people inside and outside the White House that housing prices were inflated and that a foreclosure crisis was looming. And when the economy deteriorated, Mr. Bush and his team misdiagnosed the reasons and scope of the downturn; as recently as February, for example, Mr. Bush was still calling it a "rough patch."

Post a Comment